ADVERTISEMENT

You can benefit significantly from the best cashback credit cards for new cardholders. These cards offer rewards that allow you to earn money back on your everyday purchases, making it easier to save over time.

Choosing the right card is essential for maximizing your benefits and enjoying unique features tailored to your spending habits. Don’t miss out on fantastic offers designed for new users.

Keep reading to discover how you can make the most of these cashback opportunities!

Top 5 Cashback Credit Cards for New Cardholders

Finding the best cashback credit cards can be exciting for new cardholders. Several cards offer great rewards, helping you get money back on purchases you make every day. Whether you shop for groceries, gas, or online items, cashback cards can make those purchases more rewarding.

ADVERTISEMENT

The first top pick is the Chase Freedom Unlimited. This card offers a fantastic 1.5% cashback on every purchase, with no limit on the rewards you can earn. Plus, new cardholders can enjoy a bonus after spending a certain amount in the first few months.

Another great choice is the Discover it Cashback card. It provides 5% cashback on rotating categories each quarter and 1% on all other purchases. The unique feature is that Discover matches all the cashback you earn in your first year, making it an attractive option for new cardholders.

Understanding Cashback Rewards

Cashback rewards are a way for credit card companies to give money back to you for purchases you make. When you use a cashback card, you earn a percentage of what you spend, typically between 1% and 5%. This money can be earned on all kinds of purchases, from shopping to dining out.

To understand cashback rewards better, it’s important to know how they work. For each dollar you spend, your card will put a certain percentage back into your account as a reward. Some cards even offer special deals that give higher percentages on specific categories like groceries or gas. It’s a simple and fun way to earn while you shop!

New cardholders should also pay attention to the terms of cashback rewards. Some cards may have limits on how much you can earn in certain categories. It’s smart to read the fine print so you can take full advantage of the benefits and maximize your rewards over time.

Card Features That Matter

When choosing a cashback credit card, certain features can make a big difference. For instance, the percentage of cashback you earn is important. Some cards offer fixed rates, while others may provide rotating categories that change every few months. Knowing how much you can earn in different spending areas helps you maximize your rewards.

Another feature to consider is the card’s sign-up bonus. Many cards give new cardholders a bonus if they spend a certain amount within the first few months. This bonus can be a great way to get extra rewards right from the start and can significantly boost your cashback earnings.

Lastly, look at additional perks like no annual fees or foreign transaction fees. These features can save you money and make your card more valuable. A card with useful benefits that align with your spending habits will help you get the most out of your cashback rewards.

Best Practices for Using Cashback Cards

Using cashback cards wisely can help you earn more rewards. One best practice is to pay your balance in full every month. This prevents interest charges that can wipe out the cash you earn. Staying within your budget also helps you avoid debt while enjoying the benefits of your card.

Another important tip is to keep track of your spending categories. Many cashback cards offer higher rates for specific purchases like groceries or gas. By knowing where you earn the most, you can adjust your spending to maximize your cashback rewards and get the best value from your card.

Lastly, take advantage of bonuses and promotions. Some cards provide special offers that can help you earn extra cashback during certain times of the year. Stay connected with your credit card issuer to learn about these opportunities and make the most out of your cashback experience.

How to Choose the Right Card

Choosing the right cashback card starts with knowing your spending habits. Think about where you spend the most money, like groceries, gas, or dining out. By selecting a card that offers higher rewards for those categories, you can earn more cashback and get the most value from your purchases.

It’s also important to compare different cards and their features. Look for things like the cashback percentage, sign-up bonuses, and any fees that may apply. Some cards have rotating categories, while others provide a flat rate on all purchases. Find a balance between rewards and potential costs.

Lastly, consider the card’s customer service and flexibility. Good customer support can help you resolve issues quickly, while flexible rewards can adapt to your lifestyle. Read online reviews and ask friends for recommendations to help you make an informed decision.

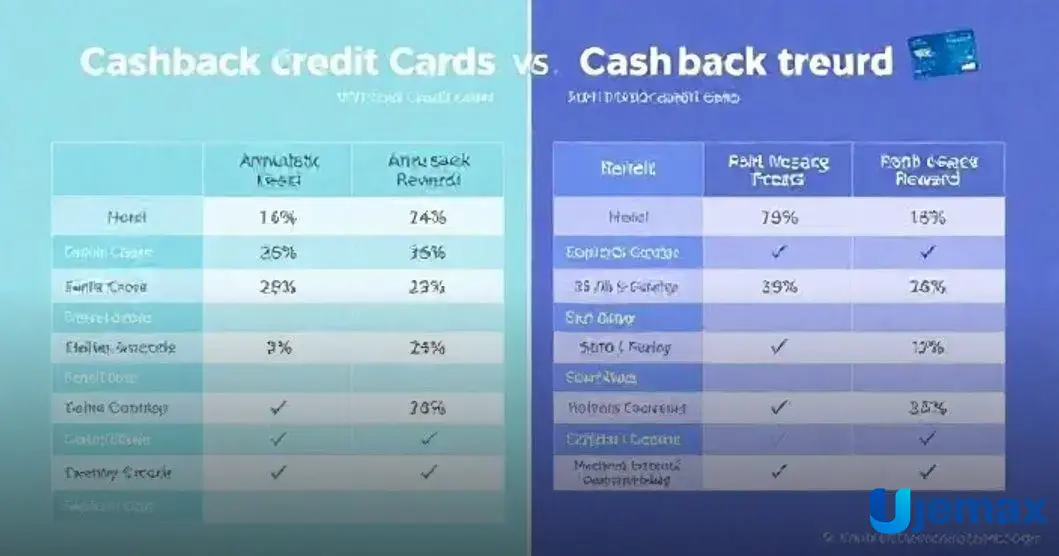

Comparing Annual Fees and Rewards

When comparing cashback credit cards, one of the key factors to consider is the annual fee. Some cards charge a yearly fee, while others do not. It’s important to weigh this cost against the potential rewards you can earn. If a card has a high annual fee but offers generous cashback rewards, it might still be worth it if you spend enough to cover the fee.

Rewards can vary significantly from card to card. Some might offer a flat cashback rate, while others have different rates for various categories like dining or shopping. Look to see how much cashback you can earn in categories where you spend the most money. A card that matches your spending habits will give you the best return on your investment.

Finally, consider how often you can redeem your rewards. Some cards allow you to cash out whenever you reach a certain threshold, while others may restrict redemption to certain times of the year or require you to meet specific conditions. Understanding these differences can help you choose a card that maximizes your benefits, making it easier to enjoy your cashback.

Tips for Maximizing Your Cashback Rewards

To maximize your cashback rewards, start by understanding your credit card’s spending categories. Many cashback cards offer higher percentages for specific purchases, like groceries or dining out. Focus on using your card for those categories to earn more cashback, and consider even using it for bills, where applicable, to boost your rewards further.

Next, always keep an eye out for special promotions or bonus offers from your credit card issuer. These promotions can provide extra cashback on certain purchases or during particular times of the year. By participating in these offers, you can significantly increase your overall rewards and make the most of your card.

Lastly, track your spending and rewards regularly. Some credit card apps have features that help you monitor your earnings in real-time. By staying organized, you can make informed decisions about when and where to use your card, ensuring you never miss out on any cashback opportunities.